10-Year Yield Eyes Major Breakout – A Return to 5% Could Be Imminent

Stocks were modestly lower, but there was a clear risk-off tone throughout the day as rates rose sharply, along with the dollar.

The CDX high-yield credit spread index also moved higher. Despite the S&P 500 finishing down about 20 basis points, the day felt much worse, with the equal-weighted S&P 500 dropping more than 80 basis points.

Market breadth was poor as well, with only 80 stocks up and 419 stocks down on the SPX.

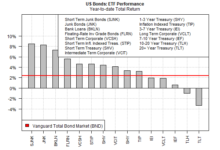

In the meantime, the 10-year yield broke above resistance yesterday, closing just shy of 4.2%.

The key level to watch is around 4.35%—a move above that could signal a major breakout, potentially pushing the 10-year back to the 5% highs seen last October.

As previously noted, the 10-year yield could even be headed toward 6%. This isn’t far-fetched, especially if overnight swaps for Fed Funds rates are correct in suggesting the neutral rate is around 3.5%.

If the 10-year trades 200 basis points above the Fed Funds rate, that brings it to 5.5% fairly easily. If it trades closer to its historical spread of nearly 300 basis points, we could be looking at a yield closer to 6.5%.

Nvidia Did It Again

If you’re wondering why the market didn’t drop even further despite such a rough day, the answer is simple: Nvidia Corporation (NASDAQ:NVDA). The stock rose more than 3% as options traders continued their activity. Yesterday, the $140 weekly options expiring this Friday helped support the market. In fact, Nvidia accounted for 150% of the gains in the Bloomberg 500 yesterday, contributing about 5.7 points.

This explains why the equal-weighted S&P 500 was down 83 basis points, while the S&P 500 was only down 18 basis points for the day.

In the meantime, Nvidia saw its implied volatility (IV) rise yesterday while skew fell, signaling a clear gamma squeeze. More importantly, Nvidia’s IV is nearing 60%, a level the stock historically struggles with. This is likely because, at that IV level, call options become less profitable.

Higher Rates Have Big Impacts

It was a rough day for small-cap stocks, with IWM dropping 1.6% as the 10-year rate surged nearly 11 basis points. IWM failed to break through the $226 resistance level for the second time since July.

In the meantime, the HGX Housing Index dropped nearly 3% yesterday, finding support at the uptrend line that’s part of the bump-and-run pattern it has formed. As rates continue to rise, it’s increasingly likely that HGX will keep declining.

The same likely applies to sectors like biotech, which fell nearly 1.7% yesterday. They seem to move in tandem with TLT.

Have a good one

Original Post