2 CEFs to Protect Capital and Get Up to 12.1% Yields

Of course, we all love it when the stock market soars like it has. But what if stocks pull back? We’ve already seen three big drops this year, so it’s fair to think another one could be lurking around the corner.

With that in mind, it makes sense to diversify beyond stocks—especially now. There’s a type of closed-end fund (CEF) out there that’s perfect for this: those that hold municipal bonds, which are issued by state and local governments to fund infrastructure projects.

CEFs, as members of my CEF Insider service know, are great buys for income (the average CEF yields around 8% today) and gains: These funds’ discounts to net asset value (NAV, or the value of their underlying portfolios) give us price gains as they narrow.

Municipal bonds add an ingredient of stability to this gain-and-income recipe, because:

- “Muni” income is tax-free for most Americans. This could mean a lot for you, depending on your bracket. (We’ll talk numbers, and tickers, in a bit—but we’re looking at yields up to 12.1% here).

- The Federal Reserve is cutting interest rates, boosting the value of the already-issued (and therefore higher-yielding) munis these CEFs own.

- Muni bonds basically never default (and if the market ever did get wobbly, we can be assured the Fed would step in).

Right now, there are two muni-bond CEFs out there that offer a good way to diversify away from stocks. Let’s take a look at both.

Muni-Bond Contender #1: A California-Based Fund With a Deceptively High Yield

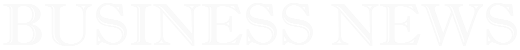

Our first CEF, the Eaton Vance California MBF (NYSE:EVM), yields 5.3% as I write this and, as the name says, has a California-centric approach:

Source: Eaton Vance

This could make it an appealing choice for California residents, as they benefit from both federal and state tax exemptions. The downside? The fund’s focus on the state adds a level of geographic risk—should California face budget constraints or defaults on certain projects, the impact on EVM could be significant.

That said, EVM holds California bonds from across various sectors, like education, healthcare and essential services. This makes the portfolio resilient—hospital and school-district bonds, after all, basically never default.

Moreover, the fund emphasizes highly rated bonds, lowering credit risk and partly explaining why EVM’s 5.3% yield is a little low for a muni-bond CEF.

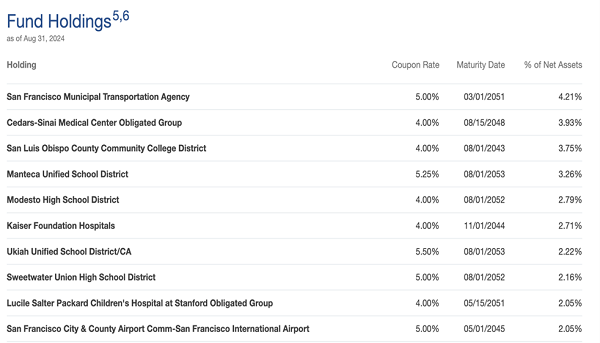

But this is where those tax breaks make a big difference: If you’re in the highest tax bracket, its 5.3% yield packs a bigger punch than it appears to: a healthy 8.8% on a taxable-equivalent basis:

Source: Bankrate

We’ll talk about the fund’s discount in a moment. But before we do that, let’s look at our second muni-bond fund: the Invesco Value Municipal Income Closed Fund (NYSE:IIM).

Muni-Bond Contender #2: A “Nationwide” Fund That Could Pay You 12.1%

IIM adds a degree of safety by spreading its holdings across the US muni market. That lets it cherry-pick bonds from states or municipalities offering the best risk-adjusted yields. And unlike EVM, IIM can sidestep any disaster in a specific state.

Yet something does seem a bit odd here: Its yield. Because even though IIM seems to offer lower risk than EVM, it yields a much higher 7.3%.

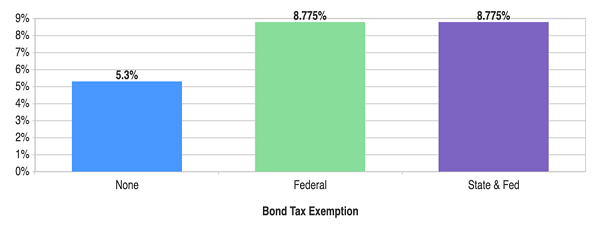

For top-bracket taxpayers, that comes out to a massive 12.1% on a taxable-equivalent basis. And that dividend recently saw a big hike after the payout drifted lower in the last few years.

Source: Income Calendar

Part of that higher yield is explained by IIM’s dividend history: As you can see above, it cut payouts in 2022 and 2023, as many muni-bond funds did, with the Fed in rate-hiking mode (thereby reducing the value of the bonds these funds hold—the opposite of today’s situation).

In fact, IIM had more cuts than EVM. This stems from the “value” in its name. IIM tries to buy oversold munis with potential to rise in value or maintain their payouts more than the market expects.

As a result, IIM has a mix of lower-rated bonds, with higher allocations to “revenue bonds” (where the bond’s income is tied to the income produced by an asset built by the bond’s funding, a structure commonly used for things like toll roads). These often carry more yield potential but slightly higher risk, too.

This is the real reason for IIM’s bigger yield: it is investing in the riskier end of the muni world, so if you buy into it, you should be compensated for taking on that extra risk.

This is where one of the most important features of CEFs comes into play.

The Discounts: Which of These 2 Funds Is the Better Deal?

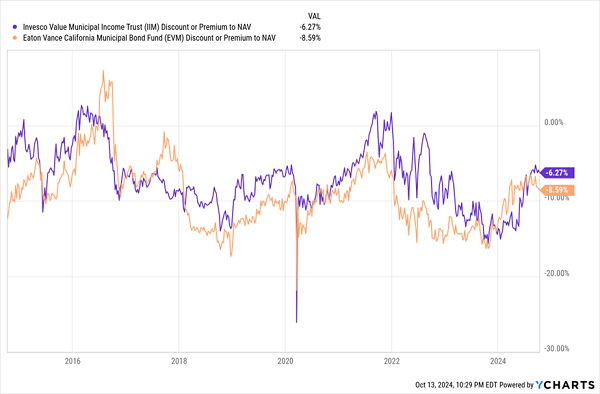

One of the key attractions of both of these CEFs is their discounts to NAV, and EVM—our California-focused fund (in orange above)—trades at a much more generous 8.6% discount as I write this. This means the higher risk from IIM, our “nationwide” fund (in purple), isn’t really being properly compensated for with the CEF’s smaller 6.3% discount, especially since its long-term 10-year average discount is 6.9%.

However, EVM’s long-term discount was about 9% over that period, as well, so it doesn’t seem like EVM is unusually oversold now, either.

But EVM’s bigger discount, given its lower risk profile, does suggest it’s the better pick of these two funds: While having all its eggs in California’s basket is one risk, it’s unlikely to cause major damage in the short term. Meantime, a selloff of munis more broadly could hit the market pricing of the lower-rated bonds in IIM’s portfolio.

For those reasons, EVM makes more sense if you’re worried about short-term risk and want to maintain a strong income stream while you wait for stocks to dip.

Final Verdict: EVM for Safety, IIM for Yield

If you’re a California resident and looking for a conservative municipal-bond CEF with state tax benefits and strong credit quality, EVM is a great choice. Its focused portfolio and modest but solid 5.3% yield offer stability in uncertain times, and it’s probably your best bet if the market takes another tumble.

If you’re bearish on the market (and California) longer term, IIM is the better buy. With its 7.2% yield, broader exposure and attractive discount, it offers a compelling combination of high income and upside, thanks to its portfolio’s value focus.

5 Monthly Dividends (Yielding 10.5%) to Protect Yourself From a Crash

Big, safe dividends like the one kicked out by IIM are, hands-down, the best way to skate through the next pullback. And the 5 high-yielding—and monthly paying—CEFs I’m pounding the table on now (average yield: 10.5%) are at the top of my list of “pullback-resistant” buys.

The reason why starts with that massive payout: When you’re picking up a safe 10.5% in dividends alone, you can sit back and collect your payouts—and pocket your rich income stream—during a downturn, while everyone else panics.

The fact that these 5 dividends come your way monthly only sweetens the deal. For one, monthly dividends roll in along with our monthly bills. Great! But they also let us go on offense, letting us reinvest our payouts quicker, too. And in a pullback, we can use these payouts to buy more high-yielders at bargain prices.

The result? More gains down the road–and a bigger income stream, too!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, «7 Great Dividend Growth Stocks for a Secure Retirement.»