3 Market Signals Indicating Risk-On Sentiment Is Here to Stay

- The market continues to defy cautious outlooks, with key indicators signaling renewed risk appetite.

- Consumer discretionary stocks outperforming staples hint at a bullish trend taking shape.

- Tightening credit spreads and high-beta momentum suggest growing investor confidence.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

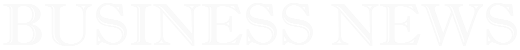

After two years of skepticism, the market has defied a chorus of naysayers who doubted its resilience. If you find yourself surrounded by pessimists, remind them of the dire forecasts made for 2023.

Many strategists expected a market crash, with some predicting the S&P 500 would post its first annual loss of the century. Instead, the index surged by 26%, proving them wrong.

Fast forward to 2024, and the outlook remains similarly cautious, yet the market continues to perform. With that in mind, let’s dive into three key indicators that signal increased risk appetite in the market:

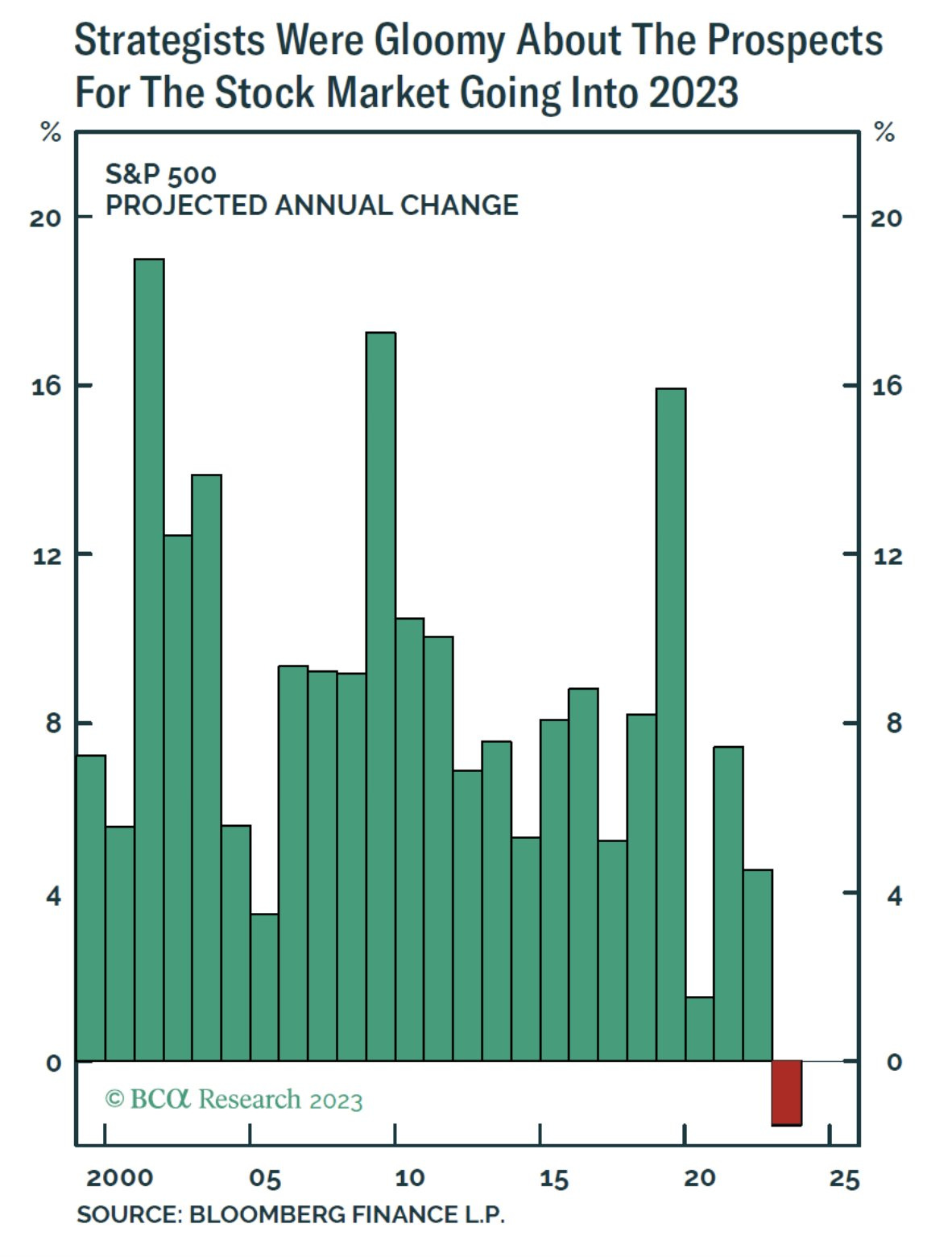

1. Consumer Discretionary vs. Consumer Staples Stocks

One of the most reliable indicators of risk-on sentiment is the ratio of consumer discretionary (NYSE:XLY) to consumer staples (NYSE:XLP).

Historically, this ratio has signaled major turning points in the market. For instance, the ratio peaked in late November 2021, hinting at the market’s shift just before the 2022 bear market.

Similarly, it bottomed in December 2022, two months before the broader market confirmed the start of a new bull cycle.

Lately, we’ve seen this ratio oscillate, but recent action suggests risk appetite is rising again.

A decisive break above the 2.5 resistance level would be a strong bullish signal, indicating investors are willing to take on more risk. If this ratio hits a new high, it would confirm continued bullish momentum.

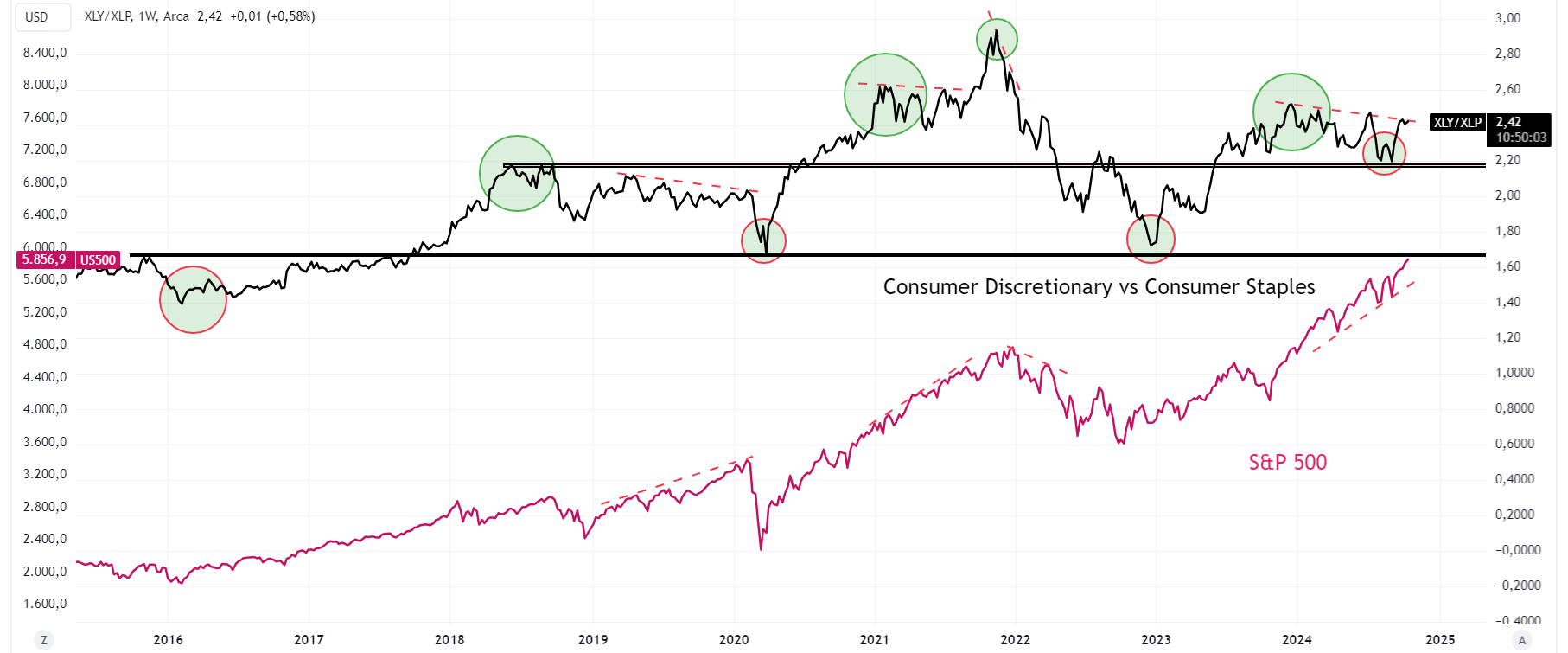

2. Credit Spread Movements

When markets face pressure, credit spreads tell the story.

These spreads reflect the risk premium investors demand for holding debt from less stable companies. In times of fear or volatility, high-yield bonds (NYSE:HYG) are often the first to get sold off, widening the spread.

After a brief period of heightened fear in August and September, credit spreads have tightened again, suggesting investors are more comfortable with risk.

The spread between high-yield bonds and safer options like the United States 10-Year has not only rebounded but has also surpassed previous highs from earlier in the year.

This trend supports the case for a bullish market, as shrinking credit spreads indicate investor confidence in riskier assets.

3. High Beta Stocks’ Momentum

The ratio between high beta stocks (NYSE:SPHB) vs. low-volatility stocks (NYSE:SPLV), known for their volatility, often provide a clear signal of risk appetite.

This ratio hit its peak in mid-July 2024, before stalling out. Although high beta stocks have rallied since their September low, the ratio hasn’t reclaimed its July highs, even as the S&P 500 continues to notch new records.

This divergence between high beta stocks and the broader index typically doesn’t last long—one will correct to follow the other.

In the weeks ahead, it will be crucial to watch whether the high-beta stocks vs low volatility stocks ratio regains momentum. If the ratio starts climbing again, it could reaffirm a short-term bullish outlook.

These three indicators—consumer discretionary vs. staples, credit spreads, and high beta stocks—offer valuable insights into where the market might be headed. Keep an eye on them to gauge risk sentiment and position yourself accordingly.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.