S&P 500: SPX/TLT Ratio Signals Bullish Setup Ahead of 2024 Elections

SPX Monitoring purposes; Sold long 9/13/24 at 5626.02= gain 2.23%; Long SPX on 9/5/24 at 5503.41.

Sold SPX on 8/19/24 at 5608.25 = Gain 8.14%gain; Long SPX on 8/5/24 at 5186.33.

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

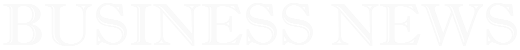

We are up over 28% this year so far; SPX up around 22%. We keep updating this chart as its relative how the next low in the market may form. The top window is the RSI for the SPX/TLT ratio and the SPX/TLT ratio is the next lower window.

We would like to see the RSI reach near 30 on the SPX/TLT ratio for a bullish setup going into the 2024 Election. Both previous Elections lows in 2016 and 2020 where Trump was a candidate, produced RSI near 30 and it’s likely it will happen this time around. Our downside target is the gap that formed on 9/19 near 5600 SPX (noted with dotted blue line).

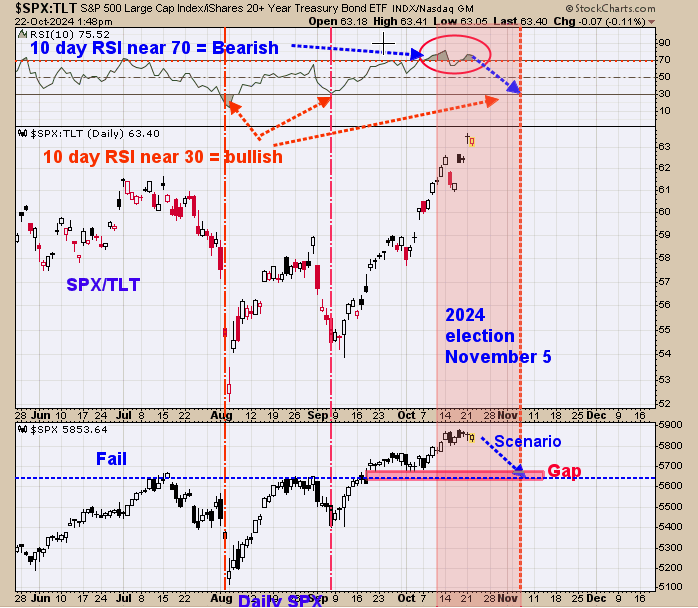

The middle window is the SPY. We circled in blue when the SPY closes more than 50% outside of its outer Bollinger band; which indicate market has gone to far past the norm and due for a reversal.

In mid-October the SPY closed more than 50% of its out Bollinger band suggesting a reversal is possible. Seasonality wise a corrective wave starts around mid-October and declines into the election which is November 5 and the SPY/VIX divergence (not shown) along with the RSI above 70 on the SPX/TLT ratio suggesting this potential pullback is likely.

The bottom window is the weekly GDX cumulative advance/decline percent and the next higher window is the weekly GDX cumulative up-down volume percent, both with their Bollinger bands. These indicators pick out multi-month or longer moves in GDX.

The signals are generated when both indicators close above their mid-Bollinger bands (buy signal) or close below (sell signal). The last signal came in late March (noted on the chart above) which was a buy signal. These indicators can show divergences (noted in shaded pink) when GDX makes higher highs and both indicators make lower highs suggesting a pullback in GDX is anticipated.

Currently, there is no divergence as both indicators are making higher highs along with GDX.